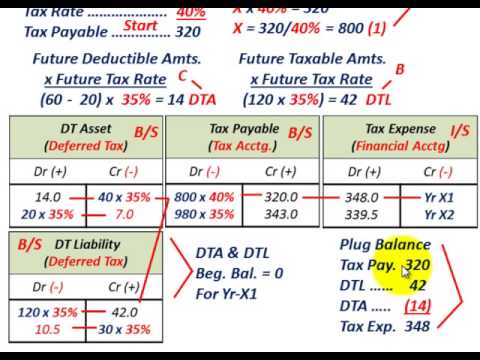

Deferred Tax Asset & Deferred Tax Liability (Basic Understanding, Tax Vs Financial Accounting) - YouTube

Training - Modular Financial Modeling II - Corporate Taxation - Detailed Modeling - Deferred Tax Assets | Modano

Glass transition temperatures (Tg) calculated from DTA curves and (Tg)... | Download Scientific Diagram

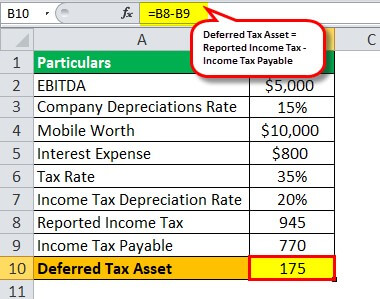

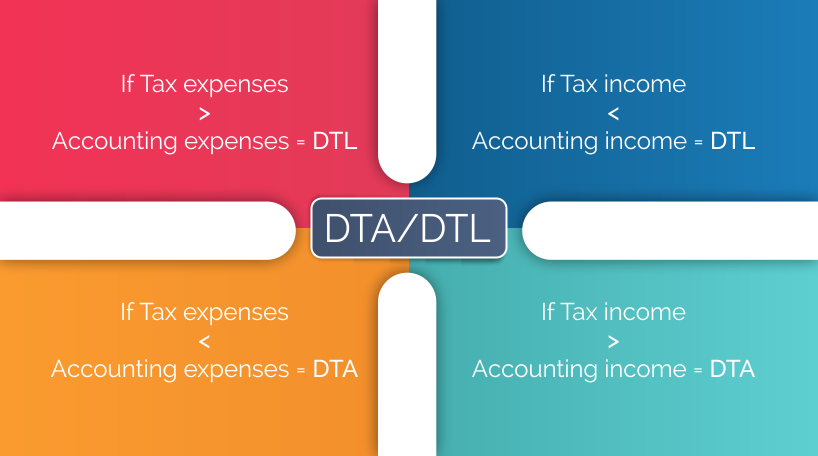

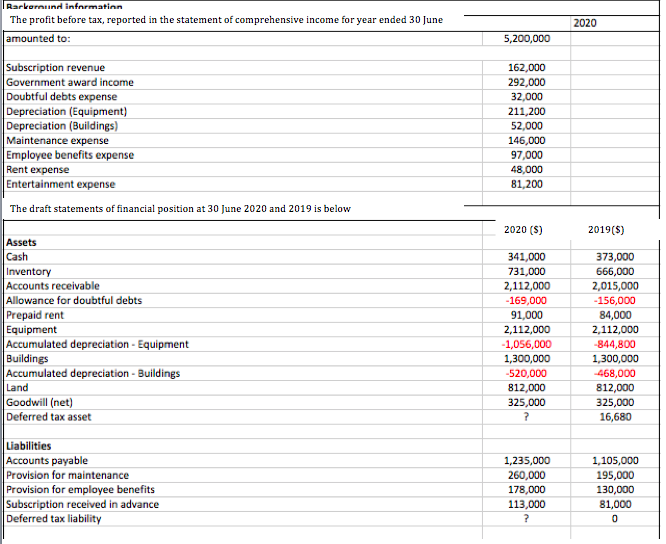

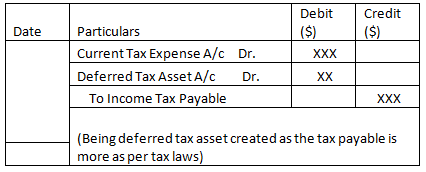

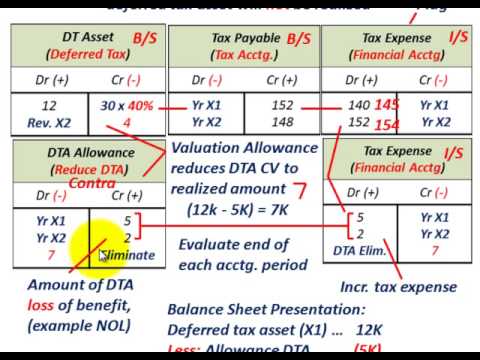

What is Deferred Tax asset & liabilities & How to Calculate deferred Tax| Deferred tax - Concept - YouTube

![Russia] Tax differences calculation by balance method - Microsoft Support Russia] Tax differences calculation by balance method - Microsoft Support](https://support.content.office.net/en-us/media/40258458-7b7c-e68f-eeee-2b84d09c8d29.png)

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)